Second quarter earnings season is in the books, and it was a good one. S&P 500 companies collectively grew earnings at a double-digit pace for the first time in three years. Companies beat estimates at a solid 79% clip. Guidance from company CEOs and CFOs was relatively upbeat. And although some were a bit disappointed by big technology results based on stock reactions, the problem was high expectations more than anything else.

The Numbers

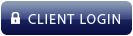

Second quarter numbers were quite good and generally in line with LPL Research’s expectations. In our earnings preview on July 1, we called for double-digit earnings growth and we got it — S&P 500 earnings per share (EPS) grew nearly 12% in the quarter, or over 13% excluding a $9.1 billion write-down of media assets by Warner Brothers Discovery (WBD). Profit margins expanded quarter over quarter by a not insignificant 0.4%, indicating companies did a good job controlling costs.

Earnings Growth Accelerated Nicely in Q2, Keeping Second Half Expectations High

Source: LPL Research, FactSet 09/05/24

Past performance is no guarantee of future results. Estimates may not develop as predicted.

In that earnings preview, we cited resilience of estimates during the second quarter, steady economic growth, and healthy Asian export activity as reasons to expect good results overall. Those factors certainly contributed to solid revenue growth for the S&P 500 of 5.2%.

At the same time, a strong U.S. dollar, weak manufacturing surveys, and sub-par economic surprise indexes (most U.S. data fell short of economists’ forecasts from mid-April through mid-July) suggested capped upside potential. Those factors did contribute to less upside to estimates, with an average upside earnings surprise below 4% after average surprises over 7% in three of the prior four quarters.

Technology Got By With a Little Help From Its Friends

We had expected mega cap technology companies to be big drivers of earnings growth, and they were. More than six percentage points, or more than half of the S&P 500 EPS growth last quarter came from the top six technology companies — Alphabet (GOOG/L), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), and NVIDIA (NVDA).

The other 494 contributed slightly less than six points, still a solid improvement from recent quarters. Healthcare and financials made solid earnings contributions. In fact, a strong second quarter earnings season was one of the reasons for our upgrade of the healthcare sector last week to neutral from underweight. The sector grew earnings year over year for the first time since Q2 2022. Strength in consumer finance and insurance helped drive solid upside for the financial sector, where our asset allocation committee maintains its neutral stance.

Markets Weren’t Impressed

Perhaps the most disappointing thing about second quarter earnings season was the market reaction. From July 15 through the end of August, the S&P 500 was essentially flat, including an 8.5% drop that culminated in the volatility spike on August 5. The good news is the S&P 500 rallied back on results in August, at least before using NVDA results on August 28 as a reason to pull back again — though by only about 3% so far. Results weren’t enough to drive stocks higher, but it’s fair to say they were a key factor — along with falling inflation and supportive economic data after the weak July job report (released on August 2) — in helping stocks recover most of the 8.5% drawdown in less than three weeks.

Forward four quarter S&P 500 EPS estimates fell just 1% during the Q2 reporting season, about half the typical cut and a good result. The percentage of companies reducing guidance was slightly better than the norm. However, it wasn’t good enough to drive stocks higher as the soft-landing debate continued and seasonality, geopolitical threats, and policy uncertainty added to the headwinds.

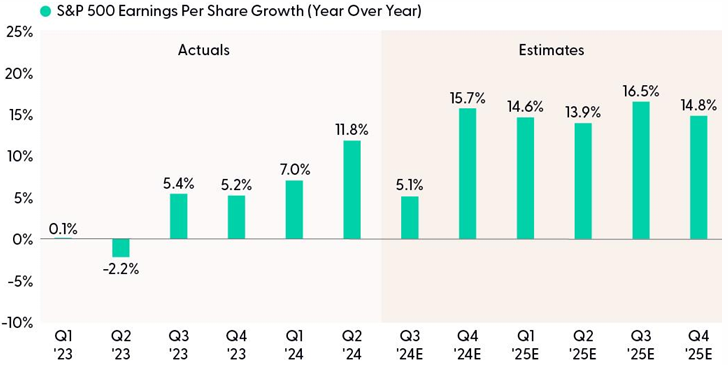

Earnings Growth Gap Between the Magnificent Seven and the “493” is Narrowing

As noted above, the Magnificent Seven drove more than half the earnings growth last quarter. For just six companies (Tesla’s (TSLA) earnings fell but we’ll still count it as one of the Seven) to drive that much earnings growth for an index of over 500 public companies is remarkable. The average earnings growth for those six in the quarter was over 60% (for all seven it was 46%) and it should be around that same rate for the full year 2024. That is tremendous growth, especially for such large companies.

The massive capital expenditures into artificial intelligence (AI) have made us hesitant to recommend an overweight to value stocks — although outperformance by value stocks over the past six weeks is encouraging.

One of the reasons our asset allocation committee is starting to get more interested in value stocks is the broadening out of earnings growth. The “493” certainly aren’t seeing anywhere close to the earnings growth the Magnificent Seven is currently seeing (TSLA aside). But in the coming quarters that gap will narrow quite a bit, which we would expect to be a catalyst for the value-leaning 493. The broadening out of earnings growth is positive for the health of this bull market, but the massive weight of the big technology names may make for a bumpy transition to potential value outperformance.

Earnings Growth Gap Between S&P 500 and Magnificent Seven To Narrow in 2025

Source: LPL Research, Strategas Research, Bloomberg 09/05/24

Past performance is no guarantee of future results. Estimates may not develop as predicted.

Magnificent Seven includes Alphabet (GOOG/L), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA)

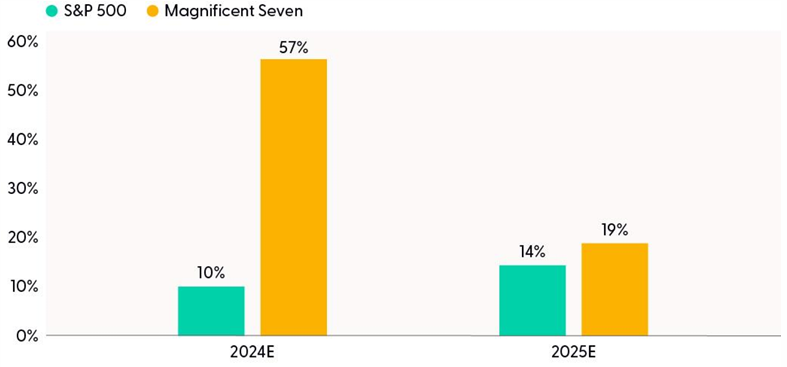

Latest Thinking on Earnings for the Rest of 2024 and 2025

With valuations elevated, earnings must hold up to support stocks, and they have generally been doing their part. While the stock market’s response to results has been underwhelming, the resilience of 2024 and especially 2025 S&P EPS estimates has been impressive. Earnings miss estimates roughly 90% of the time, and typically by more than 5%. This year’s S&P 500 EPS will likely end up close to the estimate at the start of the year (maybe a couple dollars lower), while the rise in the consensus estimate for 2025 over the past year is highly unusual and, we think, suggests underlying strength.

Earnings Estimates Holding Up Remarkably Well

Source: LPL Research, FactSet, 09/05/24

Estimates may not materialize as predicted.

Here are some key factors supporting the earnings outlook over the rest of this year and in 2025:

- Steady but slowing economic growth with slightly above-average inflation is a good environment for revenue growth.

- Corporate America is not dealing with supply chain problems anymore.

- Margins are on the upswing, at least for now, as companies effectively control costs and get enough pricing power even as inflation comes down (lower inflation all else equal, means small price increases and, therefore, less revenue growth).

- Investment in AI remains strong. It won’t always be this strong, and the scrutiny on returns on those investments will only increase over time, but for now, that investment is boosting earnings.

- Down the road, consumers of AI will discover productivity enhancements, which is expected to lift the bottom line. The effects on efficiency and profitability will likely be material for many companies.

- Though currency movements are notoriously hard to predict, Federal Reserve (Fed) rate cuts may weigh on the U.S. dollar, a possible boost to profits for U.S.-based multinationals operating around the world.

These positive factors are offset by a slowing U.S. economy, which limits revenue growth opportunities. A sluggish Chinese economy is weighing on revenue growth for some sectors, particularly natural resources. And as more consumers potentially get more strapped — we have heard from several discount retailers and dollar stores that this has already started to occur — they will push back more on high prices. These headwinds suggest estimates by Wall Street are too high. LPL Research maintains its below-consensus S&P 500 EPS forecasts for 2024 and 2025 at $240 and $260, representing growth of 10% and 8%, respectively.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral stance on equities, while actively monitoring economic data, corporate profits, and technical analysis signals for indications of potential opportunities to add equities on weakness. The Committee expects volatility to remain elevated in the coming months as the market waits for more clarity on the economy, elections, and a better seasonal setup. The STAAC maintains its modest overweight to fixed income, funded from cash, which can help buffer against equity market volatility should economic conditions worsen, while also providing attractive income.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from Bloomberg.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0001819-0824W Tracking #626283 (Exp. 09/2025)