In his recent speech, Federal Reserve (Fed) Chairman Jerome Powell focused on the fragilities of the labor market and is preparing markets for the new phase for policy. “The time has come for policy to adjust.” A soft landing looks achievable, barring any shocks. Disinflation while preserving labor market strength is only possible with anchored inflation expectations, so an independent and credible central bank is key. One of the best concepts in the speech for investors to understand is the current data shows an evolving macro landscape. The jury is still out on if the Fed can successfully manage the risks to both sides of their dual mandate.

What a Difference a Year Makes

Last summer, Jerome Powell ended his Jackson Hole speech with an intimidating tone — this tone was almost gone at this year’s symposium. He pivoted his policy inclinations from “We will keep at it until the job is done” to a more calming promise that “The time has come for policy to adjust.”

This clarity is just what the markets wanted. As consumer prices are no longer rising at breakneck speed, the Fed can move on to the other part of its dual mandate for full employment.

The Fragilities of the Job Market

What we learned from Jackson Hole is the Fed is interested in preparing markets for the committee to start cutting rates at the September 18 meeting and to start a measured process of cutting throughout the rest of this year and into next.

Payroll Revisions and Candy Jars

If you’ve ever been to a county fair, you’ve probably encountered the large mason jar of candies set on the counter with an issued challenge to guess the number of candies. After a bit, those mathematically inclined could get close to the actual number.

Now, what if the candies were poured into a multi-curved vase — with a hidden Rubik’s cube inside? The previous models would not be as accurate since the curves add another level of complexity. The pandemic shock is the multi-curved vase, and those at the Bureau of Labor Statistics (BLS) need to dial-in their models. We could take a deeper dive into the BLS sampling methodologies but that could be saved for a later publication.

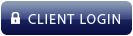

That said, the economy is likely reverting to pre-pandemic trends as corresponding data suggest businesses added roughly 174,000 jobs per month on average to their payrolls instead of the initial estimate of 242,000.

Job Market Cooler Than Originally Thought

Payroll Gains Are Back to Pre-COVID-19 Trend

Source: LPL Research, Bureau of Labor Statistics 08/26/24

Revisions occur because additional surveys come in and labor analysts cross-check their estimates with other corresponding metrics. The final benchmark revisions will be published in February next year. But for now, the key takeaway is the labor market appears weaker than originally reported. And a deteriorating labor market will allow the Fed to highlight both sides of the dual mandate. If future monthly payroll reports come in weak, investors should prepare for multiple cuts this year.

The large revisions suggest that 2023 was returning to what the labor market looked like before the pandemic.

Industries with the largest negative revisions were the professional services and hospitality sectors. In contrast, transportation and warehousing industries are expected to be revised higher. It’s not surprising that the leisure and hospitality sector is the most volatile.

The Time Has Come for Lower Interest Rates

Central bankers from around the globe meet annually in Jackson Hole, Wyoming to discuss the global economy. The event gets a lot of media hype, and for good reason, since the event is often used to introduce new policy ideas.

Here is a brief review from years past:

• 2010: Ben Bernanke popularized a version of quantitative easing (QE).

• 2014: Mario Draghi prepared markets to receive a European version of QE.

• 2016: Janet Yellen used her speech to make the case for rate hikes later that year.

• 2018: Jerome Powell talked about “Guided by the Stars” – a nod toward the concept of r*, the neutral real rate of interest.

• 2020: Powell introduces the amended strategy: “averages 2% over time.”

• 2022: Powell warned of “some pain” with rate hikes.

• 2023: Powell threatened, “We will keep at it until the job is done.”

This year, Powell specifically highlighted the labor market 27 times in his speech Friday, indicating the current focus for the Federal Open Market Committee (FOMC). He surprisingly talked about the “transitory hypothesis” and tacitly defended the argument for that view.

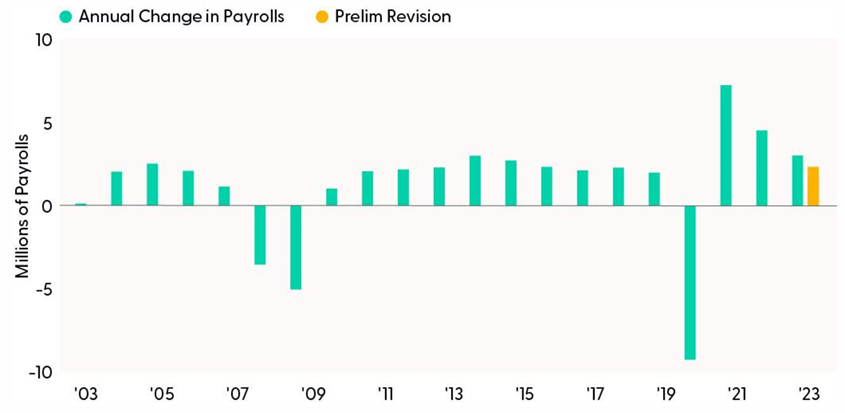

One of the underappreciated concepts in Powell’s speech is the current data shows an evolving macro landscape. The jury is still out on whether the Fed can successfully manage the risks to both sides of their dual mandate. However, Chairman Powell could not be clearer — “the time has come for policy to adjust” and yields on the 2-year Treasury anticipate the cuts as highlighted in the “Fed Positioning Toward a Series of Cuts” chart. Given the Fed’s attention to protecting and preserving the labor market, a soft landing looks achievable, barring any shocks.

Fed Positioning Toward a Series of Cuts

Treasury Yields Anticipate the Moves

Source: LPL Research, Federal Reserve Board 08/26/24

Summary

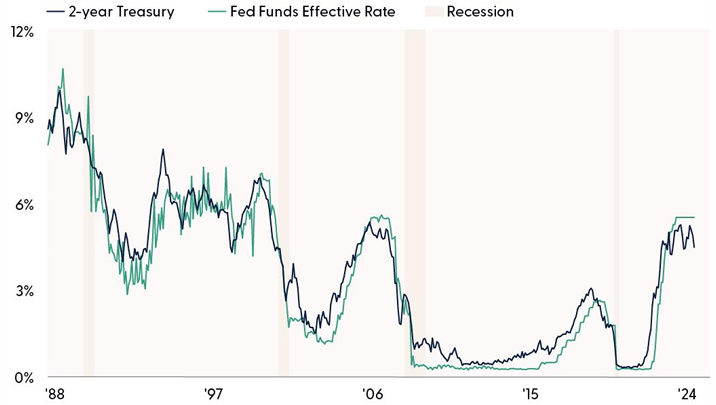

Consider your bond allocations, as rates will likely fall from here. From an investment perspective, LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral stance on equities, while actively monitoring economic data, corporate profits, and technical analysis signals. We expect volatility to remain elevated in the coming months as the market waits for more clarity on the economy, elections, and a better seasonal setup. The STAAC maintains its modest overweight to fixed income, funded from cash, which can help buffer against equity market volatility should economic conditions worsen, while also providing attractive income. The stickiness of services inflation continues to be one variable that could lead to volatility if inflation risks flare up.

Components of Inflation on Various Glide Paths

Emerging Trends Are Encouraging

Source: LPL Research, Bureau of Labor Statistics 08/26/24

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from Bloomberg.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0001659-0724W Tracking # 619845 (Exp. 08/25)